Jakub is the person who kept me from giving up on the idea of succeeding in the stock market. His personal approach, know-how, and overall mentoring style are truly unique.

After 7 years finally succeed in trading. Lot of money time and stres I paid for. At the time when I started, there was really little information about trading and I had to go through everything with my own experience. If you start trading you probably be fooled. There are lot of information around. Many of them don’t work. Trading presents itself as an easy discipline through technical analysis, but it fails. That is ultimately why so few traders are successful. Everything you need to understand to trade in a different perspective is to look at options in a practical way.

What you will learn:

We set the right expectations

Most of the traders enter the world of trading without deep knowledge on the basis of a public presentation sensation with the promise of quick and high profits on a small initial capital. At the begging this positive impulse leads to uninformed decisions that brings failure and loss.

The suitable business style is a choice

Getting started with trading is not easy, as there are many financial instruments (stocks, commodities, forex, futures, options and others) and trading styles available. The first touch trading, you will encounter is presentation of intraday trading of currencies with indicators and technical analysis, which is certainly not a long-term successful way. We will show you a method that does not give room for emotionally impulsive action and offers a real probabilistic advantage on your side compared to technical analysis.

The aim is to learn to work with options

Options may look complicated at first, but they only have two functions on both sides of the market (PUT and CALL), that means four functions in total, where it is always about of buying or selling an option. This allows us enormous flexibility in the markets, where we can, for example, collect a profit on both sides of the market with a certain combination, or, conversely, profit when the markets show a sideways trend. Compared to traditional trading, we do not have to use options to hit the direction of the market at a given moment, we can effectively limit risk and adapt to market conditions. Many of large investors use options. They can be used on various assets (shares, commodities, futures…), they are liquid, easily accessible and their tactics are universal.

In just 100 pages, you’ll gain a clear, step-by-step understanding of options, presented in a practical and visual format. Using the free ThinkOrSwim platform, you’ll efficiently turn theory into practice, saving valuable time by having everything in one place.

What you will learn in the e-book:

✔️ The basic mechanism of the asset stock exchange auction

✔️ Types of stock orders

✔️ Difference in asset and options trading

✔️ What rights and obligations derive from the option contract

✔️ What are ATM, ITM and OTM options

✔️ Intrinsic and extrinsic value of options

✔️ Decay of the time value of options (we sell time)

✔️ What effect does implied volatility have on the price of options

✔️ How to read the option matrix

✔️ Why use options

✔️ Distribution of option combinations

✔️ Buying and listing a call option

✔️ Buying and listing a put option

✔️ Vertical call and put spread

✔️ Combination of call + put spread

✔️ What are the Greek letters for (delta, gamma, theta, vega, lambda, rho)

✔️ How to backtest in ThinkOrSwim and much more…

During the 4-week program, you will receive 11 video lessons, where we will gradually introduce you to functional trading through practical demonstrations. The program is not tied to your participation at any given moment. You can study at your own pace as you need. The four week program is just your time guide to study the information in an efficient time.

The lessons are:

✔️ Financial size of the stock exchange (10:45):volumes on the exchange; demos in the trading platform; financial instruments; basic influence of emotions

✔️ Introduction to the stock market environment (14:11): choosing a broker; centralized exchange vs. OTC environment; the basic procedure of the first trade orders

✔️ Stock exchange instruments (19:07): stock indices and their instruments; business styles; basic abbreviations (tickers); futures contracts and their meaning

✔️ Trading basics (14:52): Long and short positions – entry and exit; price spread; details of the underlying asset; contract multiplication; practice in trading platform

✔️ Stock market strategy (17:45): strategy vs. characteristics of market movements; random environment; market volatility; probability; an example of a strategic approach in a trading platform

✔️ Emotions in trading (15:24): influence of emotions in live trading; fear vs. euphoria; impulsive behavior; breaking rules; live experience from trading platform

✔️ TWS platform and trading basics (59:42): setting up the platform environment; visualization and chart settings; platform control; business data; expanding trading basics – price quote, timeframes, order types, option matrix, alerts and more…

✔️ Overview of financial instruments (41:44): expanding lessons on “Stock exchange instruments” in the trading platform – shares; share fractions; stock indices; ETFs; Options; Forex; derivatives

✔️ Futures Basics (36:55): function definition and usage; leverage; expiration; margin; variation margin; e-mini; micro e-mini; how we use futures; risks of use; experience in the trading platform

✔️ Options Basics I (1:04:15): definition and distribution of option contracts; option price; purchase of call and put options; sale of call and put options; options insurance; practical demonstrations in the business platform and ThinkOrSwim

✔️ Options Basics II (42:55): options multiplication; option pricing model; options atm, otm, itm; intrinsic and extrinsic value; option price composition; time decay of options price; what affects the option price; options in the trading platform.

This is a one-time fee for lifetime access to the materials. All the materials you receive from us remain with you even after the end of the 4-week program.

Price: $299 USD incl. vat

Jakub is the person who kept me from giving up on the idea of succeeding in the stock market. His personal approach, know-how, and overall mentoring style are truly unique.

I’ve never experienced an approach like this before, and I’ve been through a lot of courses. Jakub’s course is very well-structured, comprehensive, and constantly evolving.

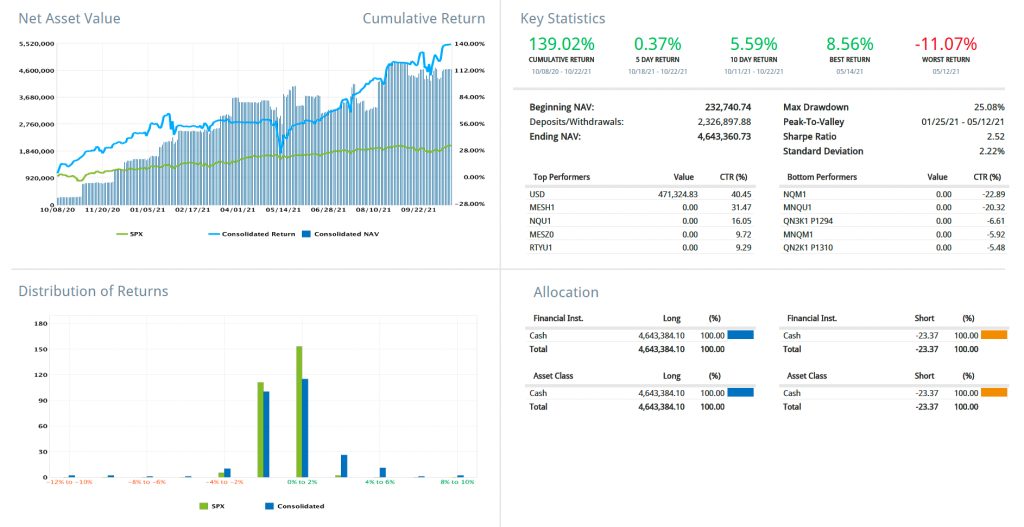

I highly recommend it! So far, I haven’t met anyone else who publicly shares their results on a large account and leads their students in the same spirit.

Jakub Kovarik

Professional trader and mentor

Since 2011, he has been developing stock market strategies, which he currently trades in his own management and mentors other traders from Czech and Slovak Republic within an online community. He focuses primarily on effective risk minimization and stable returns through options contracts. He has transformed his market-proven trading strategies into fully automated systems.